How To Tell If Your Broker Is Trading Against You

It’s a question that’s on the minds of many investors: how can I tell if my broker is trading against me? Unfortunately, there’s no easy answer. However, by being aware of the signs and taking some precautions, you can reduce your chances of being taken advantage of.

One red flag to watch out for is when your broker starts recommending investments that are not in line with your goals or risk tolerance. If you’re looking for conservative options and your broker starts pushing penny stocks or high-risk derivatives, it could be a sign that they’re trying to make a quick buck at your expense. Similarly, sudden changes in account activity can also because for concern. If you notice large deposits or withdrawals happening without any explanation, it could be a sign that something fishy is going on behind the scenes.

If you have any suspicions about whether your broker is trading against you, don’t hesitate to speak up! Ask them directly about their investment recommendations and account activity, and see if they can explain why things seem strange. If they refuse to answer or give unsatisfactory explanations, it might be time to find a new brokerage firm altogether.

When it comes to trusting someone with your money, it’s important to know that you can trust your broker. Unfortunately, not all brokers are honest, and some may even trade against their clients to make a profit. So, how can you tell if your broker is trading against you?

Here are five tips:

- Before signing up with a broker, make sure you read the fine print. This will help you understand the company’s policies and procedures.

- Be aware of any changes in your account balance that cannot be explained by normal market fluctuations. If your account balance suddenly drops without any explanation, this could be a sign that your broker is trading against you.

- Keep track of the trades that are being made on your behalf. If there are any suspicious or unauthorized trades, report them immediately to both your broker and the authorities.

- Monitor how much commission is being charged on each trade; high commissions could be an indication that something isn’t right.

- Ask for references from other investors who have used the same broker-if they have had a positive experience, then chances are good that you will too!

What is ‘Broker Is trading against you’?

It’s a term used in the financial world to describe when someone takes actions that benefit themselves at the expense of another party. For example, if you’re negotiating a deal with someone, and they end up getting a better deal than you, they’ve traded against you.

It can also refer to situations where one party is knowingly taking on more risk than necessary to benefit from something else happening elsewhere in the market. For instance, if I know there’s going to be an economic crash and I short-sell stocks before it happens, I’m trading against those who didn’t see the crash coming and are still holding onto their stocks.

This type of behavior can be very dangerous for professional traders who rely on accurate information and fair dealing to make money. It can also lead to market crashes when too many people are trading against each other.

Do brokers trade against their clients?

Some people believe that market makers and other professionals always cheat their clients by trading against them. Others think that this only happens on occasion and is not a widespread problem.

The truth is, it’s hard to know for sure what goes on behind the scenes in the world of finance. However, there are some things we do know about how brokers interact with their clients. For example, most brokers must act in the best interests of their customers. They are not allowed to engage in any form of manipulation or price gouging.

Furthermore, many brokerages now use sophisticated algorithms to ensure they get the best prices for their customers’ orders. These algorithms take into account all available liquidity providers to find the best execution possible for each trade. So, even if a broker wanted to trade against its client’s order, it would be very difficult to do so without getting caught.

In conclusion, while it’s impossible to say definitively whether brokers always trade against their clients, there are several reasons why this seems unlikely. Brokers should act ethically and fairly towards their customers, and modern technology makes it difficult (if not impossible) to engage in unfair trading practices undetected.

Can brokers manipulate the market?

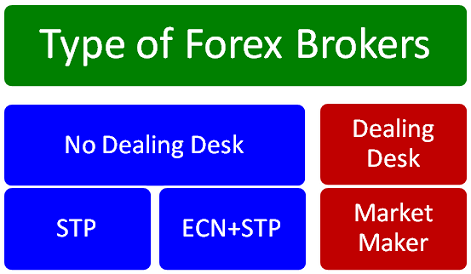

There are a few different types of brokers when it comes to Forex trading. The first type is the dealing desk broker. This type of broker trades against their clients to make a profit. They are also known as market makers because they create the market and offer prices for traders to buy and sell currencies. The second type of broker is the no-dealing desk broker, also known as an ECN or STI broker.

These brokers do not trade against their clients; instead, they pass on orders directly to liquidity providers through electronic communication networks (ECNs). This results in better prices and execution for traders. Finally, there is the leveraged broker who offers higher leverage than what’s available at most other brokers. However, this increased leverage can work both ways—it can magnify profits when used correctly, but can also lead to greater losses if trades go wrong.

Slippage is another important consideration when choosing a Forex broker. Slippage occurs when an order is filled at a price that differs from the price quoted by the trader due to market volatility or lack of liquidity at the time of placing the trade order. Some brokers offer tighter spreads but may have higher slippage rates during volatile market conditions, while others may have wider spreads but lower slippage rates under normal market conditions. You must understand how much slippage your chosen broker may cause, so you can accurately predict your potential profits and losses.

How do you check if a broker is regulated?

When looking for a broker to invest your money with, you must ensure they are regulated. This means that the financial authority has oversight of their activities, and they must comply with certain rules and regulations.

In the USA, there are two main regulators: the Financial Industry Regulatory Authority (FINRA) and the Securities Exchange Commission (SEC). Brokers registered with FINRA must adhere to a strict set of rules which cover areas such as disclosure, suitability, customer protection, and more. The SEC is responsible for regulating securities markets and all companies that offer or trade securities within them.

In the UK, there are several regulatory bodies, including The Financial Conduct Authority (FCA), The Prudential Regulation Authority (PRA), HM Revenue & Customs (HMRC), and The Serious Fraud Office (SFO). Each regulator has its area of responsibility, such as protecting consumers from bad practices or preventing financial crime.

If you’re unsure about whether a broker is regulated or not, it’s best to do some research online before investing any money with them. There are several websites that can help you compare brokers across different jurisdictions, including BrokerCheck in the USA and FCA Register in the UK.

Can forex brokers steal your money?

The answer to this question is a resounding “maybe.”

There are different types of forex brokers, and some are more likely to steal your money than others.

Dealing desk brokers, also known as market makers, are the most likely to cheat their clients. They make their profits by trading against their clients—that is, buying and selling the same currency pair at the same time to earn a tiny profit on each trade. This practice can lead to big losses for traders if they’re not careful.

On the other hand, no-dealing desk brokers (NDDs) don’t trade against their clients; they simply match buyers and sellers. Because they don’t have a dealing desk, NDDs don’t have the incentive to cheat traders. Instead, they make their profits through spreads (the difference between the buy and sell prices) and commissions charged on trades.

ECN (electronic communication network) brokers are similar to NDDs in that they don’t trade against their clients; instead, they use liquidity providers who offer competitive prices, from which ECN brokers make a small profit for each transaction executed. STP (Straight Through Processing) brokerages work in much the same way as ECN brokerages but use internal liquidity providers rather than external ones. Both ECN and STP brokerages offer tight spreads with no hidden fees or commissions.

The bottom line: If you want to avoid being cheated by your forex broker, choose an NDD or ECN brokerage like FXCM, Saxo Bank, or IG Markets. These types of firms employ honest business practices that put clients’ interests first.

How do brokers manipulate prices?

There are a few ways that brokers can manipulate the prices of assets. One way is through market makers. Market makers are firms that stand ready to buy and sell stocks, bonds, or other securities from their clients at a fixed price. They make money by buying low and selling high. Another way brokers can manipulate prices is by using a dealing desk broker or an ECN broker. A dealing desk broker uses its capital to trade against its clients to profit from the difference in prices. An ECN broker does not use its capital to trade against its clients; instead, it matches buyers and sellers electronically without acting as the counterparty on either side of the trade.

How do you beat market makers?

There are a few ways to beat the market makers.

The first way is to use a broker that doesn’t have a dealing desk. Dealing desk brokers are brokers that trade against their clients to make money on the spread. This can lead to increased slippage and decreased leverage.

No dealing desk brokers, also known as ECN or STP brokers, pass your orders directly onto the liquidity providers, which eliminates the possibility of trading against you. This can lead to decreased slippage and increased leverage.

The second way is to use a broker with high leverage. Market makers typically have low leverage, so by using a high-leverage broker, you can increase your profits when they eventually do slip up. The third way is by using limit orders instead of market orders. Limit orders allow you to specify the maximum price that you’re willing to pay for an asset or the minimum price at which you’re willing to sell it. When used correctly, limit orders can help avoid getting filled at prices unfavorable to your position.

How the stock market is rigged?

The stock market is a rigged game.

This may come as a surprise to some, but it’s the truth. The deck is stacked against the average investor and those who understand how the market works can take advantage of this fact.

There are several ways in which the stock market is rigged. Let’s take a look at some of them:

- Brokers trading against you: Most brokers are dealing desk brokers, which means they trade against their clients to make money on the spreads. This can lead to significant slippage (the difference between the price you see quoted and the price at which your order executes).

- Market Makers: These are firms that provide liquidity by buying and selling stocks all day long. They often have inside information about which companies are going to announce earnings or merger news before anyone else does and use this information to profit from trades ahead of everyone else.

- No dealing desk brokerages: There are a few brokerages that don’t have dealing desks, such as Interactive Brokers and Charles Schwab. These firms route orders through ECNs (electronic communication networks), which match buyers with sellers without acting as middlemen themselves. This leads to better prices for investors and less slippage.

- Leverage: Most brokers offer leverage, which amplifies gains (and losses). For example, if you invest $10,000 with a 50:1 leverage ratio, your broker will loan you $500,000 worth of securities. This can lead to big profits (or losses) if stocks move just 1%.

- Slippage: As we mentioned earlier, slippage occurs when an order doesn’t execute at exactly the price quoted because there was no one willing to sell at that price or because someone sold out faster than expected.

How do you protect your portfolio from market manipulation?

There are a few things you can do to protect your portfolio from market manipulation. The first is to use a broker that doesn’t trade against you. A dealing desk broker, or market maker, makes their money by trading against their clients—which means they have the incentive to manipulate the markets to make profits. A no-dealing-desk broker, or ECN broker, doesn’t trade against their clients and instead routes orders through an electronic communications network (ECN). This ensures that your order is filled at the best possible price without any interference from the broker.

The second thing you can do is use an STP (straight-through processing) broker rather than a CFD (contract for difference) broker. With CFD brokers, the spread between the buy and sell prices is usually much wider than with STI brokers. This gives market makers more opportunities to manipulate prices in their favor.

When it comes to protecting your portfolio from market manipulation, using a no-dealing-desk ECN broker is essential. When it comes to filling client orders, dealing desk brokers and market makers have an inherent conflict of interest – they make money by trading AGAINST their clients! With ECN Brokers, however, all trades are executed automatically through liquidity providers without any interference or “marking up” of spreads by the broker – meaning you get fairer prices on every trade!

Brokers can be helpful, but make sure your money will be safe

A brokerage account can be a helpful tool for investing, but it’s important to make sure your money will be safe. Many people don’t realize that there are a lot of risks associated with trading and that brokerages are not always reliable. It’s important to do your research before opening an account and choosing a reputable company.

One thing to watch out for is brokerage fraud. This occurs when a company or individual tricks investors into buying or selling stocks at artificially high or low prices. Be especially careful if you are dealing with someone who claims to be a market maker—these individuals often engage in fraudulent behavior.

Another thing to keep in mind is the amount of leverage offered by brokers. Leverage can be dangerous if it’s used incorrectly, so make sure you understand how it works before using it. Some brokers offer high levels of leverage, which can lead to large losses if the trade goes wrong.

Finally, remember that not all brokers are created equal. Some are better than others when it comes to customer service and reliability. Make sure you compare different brokers before opening an account, so you can find one that meets your needs.

- Brokers can help find the right investment, but it’s important to make sure your money will be safe.

- Market makers can help you get the best price on your trades, and broker leverage can give you more power in the market.

- However, it’s important to do your research before choosing a broker to work with. Make sure they are registered with FINRA or another regulatory body.

- Also, be aware of any potential brokerage fraud. Always review your account statements carefully and report any suspicious activity immediately.

The Dynamics of No Dealing Desks (NDD)

The dynamics of no-dealing desks (NDD) is a hot topic in the professional trading world. There are pros and cons to both the NDD and dealing desk models, and it can be hard to know which one is right for you. In this blog post, we’ll explore the dynamics of no-dealing desks, so you can make an informed decision about your trading career.

In a nutshell, a no-dealing desk broker uses market makers instead of its traders to execute orders. This allows the broker to offer tight spreads and fast execution speeds while avoiding accusations of price manipulation. However, because market makers take on the risk themselves, they usually require higher leverage than dealers do.

USA-based brokers tend to use the NDD model more often than their UK counterparts due to stricter regulations governing dealer behavior over there. Nonetheless, there are plenty of reputable UK-based NDD brokers available if that’s where you want to trade. Ultimately, it’s up to you whether you feel comfortable with an NDD. Just be sure that you understand how they work before signing up!

The Shortcomings of Working With Dealing Desk (DD) Brokers

The market for professional traders is constantly evolving, and with it, how they interact with the markets. Dealing Desk (DD) brokers were once the staple of this market, but their shortcomings are becoming more apparent.

Market Makers vs. Dealing Desk Brokers To understand the shortcomings of dealing desk brokers, it’s important to first understand how they differ from market makers. Market makers provide liquidity by continuously quoting both a bid and an offer price at which they are willing to buy or sell a security. They make money on the bid-offer spread and do not take positions in securities themselves. DD brokers, on the other hand, act as principals in transactions with their clients—meaning that when you buy or sell securities through them, you are buying or selling from them directly rather than from another trader who is using that broker as an intermediary. This can create some major problems.

1 Lack of Price Transparency: One issue is that when you’re trading through a dealing desk broker, there is often little transparency into what’s going on in the marketplace. For example, if you place an order to buy stock XYZ at $10 per share, but there’s already someone else who has placed an order at $9 per share, then your order will likely not be filled (or filled only partially). This happens because dealers often use their internal inventory to fill orders instead of looking for the best available prices elsewhere in the market as most other brokers do. So if you’re unaware of where all the orders are sitting relative to each other, it can be difficult if not impossible to get a good sense of what a “fair” price is.

2 Increased Risk: Another problem with dealing desk brokers arises due to their high levels of leverage. As mentioned earlier, dealers trade against their clients as principals, which means that they have no skin in the game when things go bad. When markets move against them, they can quickly blow through client stops, resulting in massive losses for those unlucky enough to be in front of them. This means that working with a dealing desk broker carries more risk than working with a market maker or other non-dealing desk brokerage firm.

Conclusion

If you are feeling like your broker may be trading against you, there are a few things that you can do to protect yourself. First, make sure that you understand how your broker is compensated. If they receive a commission on each trade, they are likely not working against you. However, if they earn a percentage of the profits generated by their clients’ trades, then they may be trying to generate more profits for themselves at your expense.

Additionally, always review your account statements closely to ensure that all of your transactions have been properly recorded and accounted for. If anything seems suspicious or incorrect, report it immediately to both your broker and the Financial Industry Regulatory Authority (FINRA). By being proactive and vigilant about monitoring your account activity, you can help protect yourself from any potential wrongdoing by your broker.