What Is A Forex White Label?

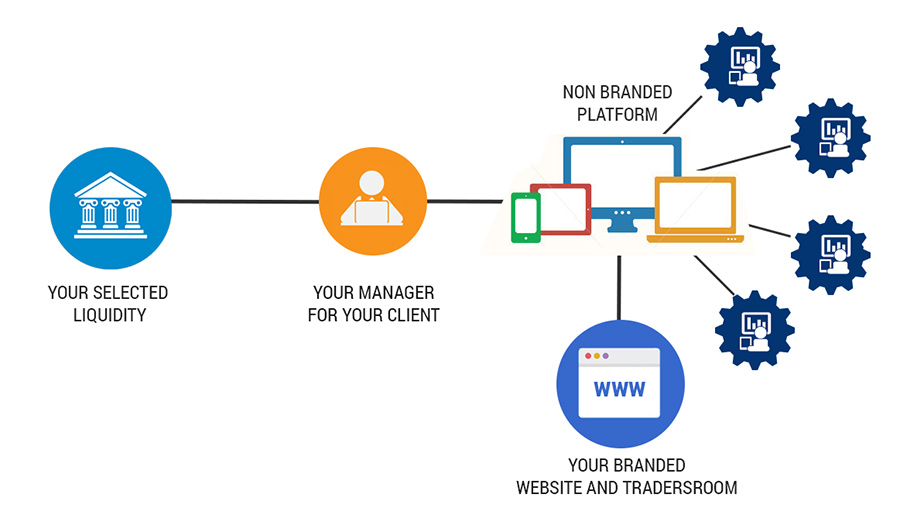

A Forex white label is an ideal solution for Forex brokers who want to start their own brokerage. It provides a comprehensive package of software, tools, and infrastructure that allows the business to get up and running quickly and efficiently. White-label providers typically offer a wide range of Forex trading products such as web-based and mobile trading platforms, back office solutions, risk management tools as well as additional value-added services like market research resources, educational materials, customer support etc.

The benefits of using this turnkey solution are numerous; it eliminates the need for costly investments in technology infrastructure or personnel training, while at the same time ensuring compliance with regulations set by regulatory authorities. Furthermore, it also helps reduce operational costs associated with setting up a new brokerage firm from scratch.

How to start a Forex brokerage

Forex trading is one of the most lucrative businesses in the world. It is also one of the most complex and difficult businesses to start. There are many things you need to do to set up a successful forex brokerage. In this article, we will discuss some of the essential steps you need to take to get your business off the ground.

The first step is finding a good location for your office or headquarters. This should be an area that is easily accessible and has a lot of foot traffic. You will also need space for your trading desk, computers, and other office equipment.

Once you have secured a location, it’s time to set up your company website and begin marketing your services online. Your website should be professional-looking and easy to use; it should also include clear information about your company policies and procedures. You will also want to create profiles on popular social media sites like Facebook, Twitter, LinkedIn, etc. so that potential clients can learn more about you online.

In addition to online marketing efforts, you must reach out directly to potential clients through personal meetings and phone calls as well. Building relationships with clients is key for any successful business venture, and this holds especially in forex trading, where trustworthiness matters more than anything else. So make sure that you put forth extra effort when networking with potential customers. Ultimately, if they feel confident doing business with you, they’ll be much more likely to convert into paying clients.

The benefits of a Forex white label

When it comes to Forex trading, there are a lot of options available for traders. You can trade currencies through a broker, or you can trade through an online platform. However, one option that is often overlooked is Forex white labeling.

White labeling is the process of outsourcing your Forex trading operations to another company. This company will then provide you with all the necessary tools and services needed to run your own FX business. The benefits of white labeling are numerous:

- Increased Efficiency: When you outsource your FX operations, you no longer have to worry about things like marketing, customer support, or order processing. These tasks will be handled by the white-label provider so that you can focus on trading instead.

- Reduced Costs: White-label providers typically offer lower costs than traditional brokers due to their increased efficiency and scale of operation

- Greater Scalability: As your business grows, it is easy to add more products and services from your white label provider without having to go through the hassle of setting up new systems 4) Brand Recognition – By using a well-recognized brand name as your forex partner, you benefit from increased trust and credibility in the eyes of traders

- Access To Cutting-Edge Technology: Forex white label solutions providers invest heavily in technology research and development so that they can offer their clients access to the latest innovations in Forex trading

- Expertise And Support: With years of experience in providing FX solutions, Forex white-label providers have a wealth of knowledge and expertise which they are happy to share with their clients.

Increased brand awareness

Setting up a Forex white label can be an extremely effective way to increase brand awareness for your company. When you become a Forex white-label solutions provider, you are essentially becoming a part of the broker’s business and their customers will see your company as the provider of the trading platform and associated services. This can be a great way to get your name out there and build trust with potential clients.

There are several things that you need to do to create a successful Forex white-label program. First, make sure that you have an excellent product that is easy to use and meets the needs of traders. Second, ensure that your branding is consistent across all channels so that customers know they are dealing with your company. Finally, provide excellent customer service so that clients feel supported and confident in their trading experience.

If you can successfully execute these three key components, then you will undoubtedly see an increase in brand awareness for your company – resulting in more leads and conversions!

The disadvantages of a Forex white label

When you are looking to start trading forex, you may come across the term “Forex white label partnership.” This simply refers to a type of partnership in which one company provides the branding and marketing for another company’s products or services. In the world of forex, this usually takes the form of an online broker white labeling its trading platform and software to a third-party provider.

While there can be some advantages to working with a white-label partner, there are also several potential disadvantages that should be considered before signing up. Here are three key things to keep in mind:

- Limited customization options: One of the main drawbacks of using a Forex white-label platform is that you typically have limited customization options. This means that if there is something about the platform or software that doesn’t meet your needs, you may not be able to change it.

- Lack of control over branding: Another downside is that you typically don’t have complete control over branding when working with a Forex white-label partner. This can include everything from how your website looks to what name is used for your business.

- Dependence on third-party support: Finally, one thing to keep in mind is that if something goes wrong with your trading account or technical issues arise, you will likely need to rely on support from your white-label provider rather than being able to contact your broker directly.

Can be more difficult to set up

Forex white labeling can be a difficult process, as it requires a great deal of trust and cooperation between the various parties involved. To create a successful white-label partnership, both the Forex broker and the liquidity provider need to be able to provide high-quality services and products that meet the needs of their clients.

The Forex broker should have extensive experience in the industry, as well as a strong understanding of what their clients are looking for. The liquidity provider must also be reliable and able to offer competitive spreads with no re-quotes. By working together closely, both parties can ensure that their customers receive an exceptional trading experience.

Facts & Data

- According to statistics, 90% of FX traders face losses, and the other 10% experience regular profits. (Source: b2broker.com)

- Brokers can select a suitable package according to their individual company’s needs, allowing for customization and scalability, while offering lower prices than the costs one would endure for multiple providers. (Source: Leverate.com)

- Keep your client data (name, email, telephone number, etc.) securely in your CRM or another external database. (Source: Xopenhub. pro)