Pipwizard Forex Managed Accounts

Start Taking Control Of your Finances Today

Managed Forex Accounts

Investing in managed forex accounts is an excellent way to grow your investment portfolio while minimizing risk. With a managed forex account, you can benefit from the opportunities of foreign currency trading without having to do any of the work yourself. Managed forex accounts provide access to professional traders who use their expertise and experience to make profitable trades on behalf of investors. This allows investors with limited knowledge or time for trading currencies themselves, an opportunity to participate in this lucrative market.

What is a Managed Forex Account?

Managed forex accounts are types of investment accounts where the investor entrusts their money to a professional money manager, who then trade it on their behalf in the Forex market. The advantage of using a managed Forex account is that it offers investors access to professional trading strategies, which can potentially result in higher profits than what could be achieved through self-trading.

When choosing a money manager for managed Forex accounts, several factors should be considered. One of the most important is experience; make sure to ask how long the manager has been trading and what type of results they have achieved in the past. Also, important is risk management; your money should always be invested per your risk tolerance level. Finally, it’s important to ensure that you trust and feel comfortable with your chosen manager – after all, they will be handling your hard-earned cash!

There are numerous advantages to managed FX trading. For starters, traders can profit from a professional trader’s knowledge and expertise. This individual will have considerable market knowledge and will be able to make informed decisions about where to invest funds to produce profits. Furthermore, by leaving their money to someone else, traders can free up time that they would otherwise spend monitoring markets and making deals on their own; this time can then be employed more profitably elsewhere or just enjoyed!

Another benefit of managed forex trading is that investors often have access to a broader choice of investment options than they would if they managed their portfolios, thanks in part to the trader’s ability to leverage his/her resources when necessary. Furthermore, because investors are not actively involved in each trading decision (this is the task of the professional trader), there is less risk connected with investing in foreign currencies (or other assets).

If you’re looking for an investment vehicle that offers potentially higher returns than traditional stock or bond investing while also providing some level of safety and security, then a managed Forex account may be right for you!

Here Is Just a Few of the Benefits of Managed Forex Accounts:

You can potentially earn higher returns than you would with other types of investments

- Your risk is minimized as professional money managers trade on your behalf

- You can access global markets 24/7

- There is no need to purchase expensive software or learn how to trade yourself

If you’re interested in learning more about managed Forex accounts, please visit our website today. We’ll be happy to answer any questions you have and help get you started on the path to financial success!

Who Should Think About Forex Managed Accounts?

If you’re thinking about dipping your toes into the foreign exchange market, forex-managed accounts could be a great option for you. With this type of account, you entrust your funds to a professional money manager, who will trade them on your behalf. Here are some reasons why you might want to consider using a forex-managed account:

- You don’t have time to trade yourself – If you’re busy with work or other commitments, trading Forex yourself may not be feasible. A money manager can take care of all the day-to-day trading for you while still giving you exposure to the market’s movements.

- You don’t know how to trade – Trading currencies can be complicated and risky if done incorrectly. A professional money manager will have extensive knowledge of the markets and will use their experience and expertise to help grow your investment portfolio safely and securely.

- You want more diversification in your portfolio – Forex is one of the most volatile markets around, so adding some FX exposure into your portfolio mix, can help reduce volatility and risk without sacrificing potential returns.

- Your current investment strategy isn’t working – If recent performance has left much to be desired, it might make sense to speak with an expert about implementing a different strategy that involves investing in currencies.

Why Should You Use Managed Forex Accounts?

There are many reasons why you might want to consider a forex-managed account. Perhaps you don’t have the time to trade yourself, or maybe you’re not confident in your ability to make money in the markets. In any case, a managed account can be a great way to get exposure to the forex market while also benefiting from the expertise and experience of a professional trader.

One of the biggest advantages of using a Managed Forex Account is that it can help reduce your risk exposure. A good manager will use risk management techniques such as stop-losses and position sizing to protect your capital while still allowing for healthy profits. This means that you can potentially make money even when markets are moving against you, which is not always possible with self-trading strategies.

Another benefit of using managed forex accounts is that it allows you access to trading strategies that may be beyond your abilities or knowledge level. By entrusting your funds with an experienced trader, you can gain access to high-performing trading systems which may otherwise be unavailable or too expensive for individual investors like yourself.

This all leads us back around full circle – by reducing risks and giving access to Trading Strategies beyond our abilities we come out ahead!

Forex trading is a popular investment choice for many people. However, some investors may find the process of trading currencies on their own to be daunting or risky. This is where managed forex trading comes in. With this type of service, an investor entrusts their funds to a professional trader, who then trades currencies on behalf of the investor.

Professional

Our team of experienced professionals will help you achieve your financial goals and grow your portfolio.

Platform

Our platform has a range of features to make your experience as smooth and successful as possible.

Risk

Our unique approach to trading allows us to achieve consistent profits while minimizing risk.

The Benefits of Managed Forex Accounts

A Forex-managed account is an excellent option for those who want to expand their investment portfolio without devoting time and energy to currency trading. By entrusting a professional money manager with your investments, you benefit from their expertise and experience in navigating the complex foreign exchange markets. This can potentially lead to higher returns than if you were trading yourself, while at the same time freeing up resources that would have been spent researching or monitoring currency pairs.

There are many advantages of opening managed Forex accounts:

- Professional management – One of the biggest advantages of using a Managed Forex Account is that your investments will be handled by professional money managers. These professionals have years of experience in trading currencies and know how to navigate through volatile markets. This can give you peace of mind knowing that your investments are in good hands.

- Diversification – Another advantage of using a forex-managed account is that it can help you diversify your portfolio. By investing in different assets, you can reduce your overall risk exposure and improve your chances for long-term success.

- Automatic rebalancing – A key feature offered by most reputable Managed Forex Accounts providers is automatic rebalancing, which helps keep an investor’s portfolio aligned with his/her risk tolerance & goals without having him being involved actively on a day-to-day basis.

- Low Costs – Most managed accounts charge low fees relative to the amount of risk involved with the investment strategy employed by the manager. This means that even if some trades go wrong, overall returns should still be positive when accounting for all costs incurred.

- Liquidity – Managed accounts offer high liquidity, as investors can usually withdraw their funds at any time without penalty. This gives investors peace of mind knowing they can access their capital quickly if needed.

How Do I Select a Good Managed Forex Accounts Service?

When it comes to managed forex accounts, there are a lot of things to consider. The first thing you need to ask yourself is what your goals are for the account. Are you looking for short-term profits or long-term growth? Once you know your goals, you can start looking at different account types and strategies that will help you reach those goals.

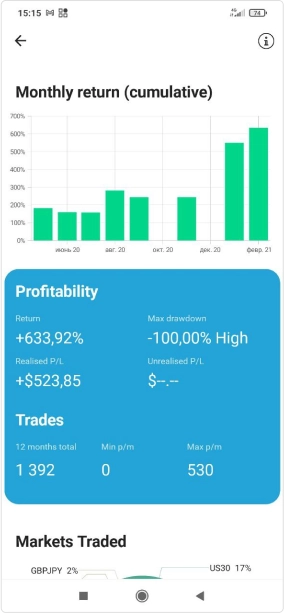

Another important factor to consider when choosing a managed Forex account is the track record of the manager. Do they have a history of success? How do their results compare with industry benchmarks? You’ll also want to make sure that the manager has a good understanding of risk management and knows how to protect your investment from sharp market swings.

Finally, be sure to ask around about any potential managers before making a decision. Talk with other investors who have worked with them in the past and get their feedback on things like communication, performance, and overall satisfaction. Taking all these factors into consideration will help ensure that you choose an account that’s right for you – and one that can help grow your money over time.

Why Our Managers Are the Best

A professional Forex account manager can help you to make the most of your investment and grow your portfolio. By entrusting your money to a pro, you can focus on the day-to-day tasks of running your business while they take care of trading for you.

What should you look for in a Forex account manager? Here are four key considerations:

- Experience and track record – Make sure that the account manager has a proven track record in trading currencies. Ask them to share their performance history so that you can see how they have fared in both up and down markets.

- Strategy – Your account manager should have a solid strategy that is tailored to meet your specific needs and risk tolerance. They should also be able to explain it simply so that you understand what is happening with your money at all times.

- Communication – You need an account manager who is responsive and easy to communicate with, via email or phone call. They should be able to answer any questions or concerns that you have promptly, without making you wait days for a response.

- Fees – It’s important to know what fees the account manager charges, as these will eat into your profits over time if not managed correctly! Make sure there are no hidden costs involved, and ask about discounts if paying annually instead of monthly.

Contact Us

Have questions or need help? Use the form to reach out and we will be in touch with you as quickly as possible.

FAQs

What are Managed Forex Accounts?

A managed Forex account is a type of investment account that is handled by a professional money manager. With this type of account, the investor entrusts their funds to the money manager who then uses their expertise to trade in the Forex market on behalf of the investor. This can be an attractive option for investors who do not have time or knowledge to trade themselves, as it allows them to benefit from professional trading skills without needing to learn about the market themselves. Additionally, because there are no commissions or fees charged on managed Forex accounts, they can be a more cost-effective way for investors to trade than if they were to attempt trading themselves.

Are Managed Forex Accounts Safe?

Managed forex accounts are a safe and potentially profitable investment option, but there are certain measures to take in order to ensure the safety of your investments. Firstly, it is important to select a reputable and experienced broker with a good track record. Secondly, you should always understand the risks involved in any type of investment before committing funds. Finally, diversification is key when investing; never put all your eggs in one basket, as this can lead to significant losses if something goes wrong. By following these tips, you can help increase the safety of your managed Forex account while maximizing potential profits and minimizing risk exposure at the same time.

What are PAMM and MAM Accounts?

PAMM and MAM accounts are an efficient way for investors to pool their resources together with a professional money manager, allowing them to diversify their investments across multiple asset classes. PAMM stands for “Percentage Allocation Management Module” and is a sophisticated automated system that allows investors to track the performance of their investments in real time. MAM stands for “Multi-Account Manager,” which provides brokers with the ability to manage multiple client accounts simultaneously, providing greater flexibility when it comes to managing funds. Both systems offer great potential benefits for any investor looking to maximize returns on investment while minimizing risk exposure through diversification strategies.