Swing Trading

Swing trading is a popular trading style among forex traders who are looking to capitalize on short-term price swings in the market. This strategy involves taking advantage of price movements that occur over several days or weeks and holding positions for longer than most day traders would typically hold them. Swing traders look for trends in the market, identify potential entry points, and then take action when they feel that conditions are favorable.

One of the main advantages of swing trading is its flexibility – you can adjust your approach depending on how much time you have available to devote to analyzing charts each night. Additionally, because swing trades often last multiple days or even weeks at a time, it allows you to benefit from larger moves in the markets without having to constantly monitor your positions throughout those periods like day traders do with shorter-term strategies.

The key thing with any type of trade is understanding what kind of risk/reward ratio works best for your own goals and circumstances; as such, it’s important not only to understand how swing trading works but also to determine if this particular style will be beneficial given your current financial situation before jumping into any trades head first!

Types of Swing Trading

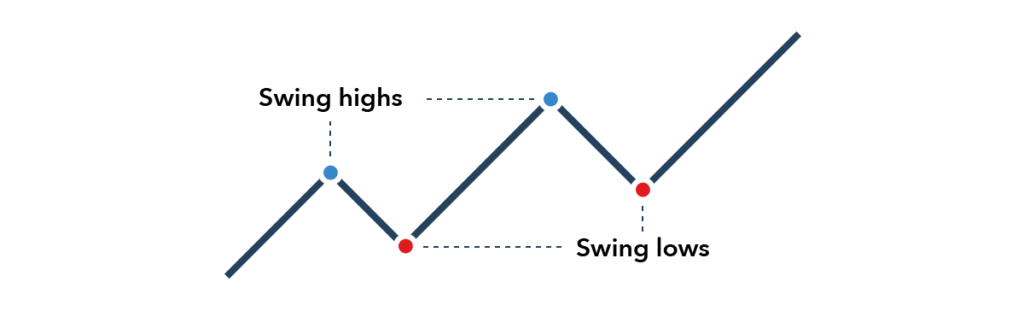

What is a swing trade?

Swing traders frequently employ a variety of trading tactics.

The four most common are as follows: reversal, retracement (or pullback), breakouts, and breakdowns.

Reversal Trading

Reversal trading relies on a change in price momentum to identify potential profits. A reversal is when an asset’s price changes direction, such as when an upward trend loses momentum and the price starts to move downwards. Reversals can be either positive or negative (or bullish or bearish), depending on the direction of the new trend that is forming. Swing traders use technical analysis tools like support and resistance levels, moving averages, chart patterns, and other indicators to help them identify reversals to capitalize on these opportunities for potential profit.

Retracement Trading

Retracement trading involves looking for short-term price movements. This strategy involves buying and selling assets based on the retracements in their prices, which are usually caused by market fluctuations or news events. Traders use technical indicators to identify entry and exit points for potential trades, as well as determine how far back the asset’s price may move before it resumes its original trend. Retracement traders often look for quick profits from small changes in pricing, rather than long-term investments with larger returns. It is important to note that this type of swing trading can be risky if not done correctly due to its reliance on short-term trends and volatility within markets; therefore, careful planning should be taken when considering any trade using this approach.

Breakout Trading

Breakout trading is a popular approach for those looking to capitalize on an uptrend in the markets. By entering into a position as soon as the price breaks above a key level of resistance, traders can take advantage of the momentum created by this breakout and ride it higher. This strategy requires careful analysis and timing, though, since if you enter too early or too late, you may miss out on potential profits from the trend. Additionally, stop-loss orders should also be used to protect against any sudden reversals in price that could lead to losses.

Breakdown Strategy

A “breakdown strategy” is a swing trading technique used when taking advantage of a downtrend. This type of strategy involves entering a position on the early side as soon as the price breaks through an important level of support. The goal of this approach is to capitalize on the downward momentum by riding it lower and profiting from any further drops in price. It’s important to note that this type of strategy requires careful risk management, since there can be no guarantee that prices will continue to fall after breaking through support levels. As such, it’s always wise for traders to use this method to set stop losses and other protective measures before initiating their positions to limit potential losses should prices unexpectedly reverse direction or stagnate at key levels instead of continuing their descent downward.

:max_bytes(150000):strip_icc()/Investopedia-terms-swing-trading-V2-c8f8ddfc266141c4ba623dc234ec47c0.png)

You might want to be a swing trader if:

- You don’t mind keeping your trades open for a few days.

- You are willing to take fewer trades but are more cautious about ensuring that your transactions are very solid setups.

- You are fine with having huge stop losses.

- You’re a patient trader.

- You can maintain your cool when trades go against you.

You might NOT want to be a swing trader if:

- You enjoy trading that is fast-paced and action-packed.

- You are impatient and want to know right away if you are correct or incorrect.

- When trades go against you, you get hot and agitated.

- You can’t spend two hours a day analyzing the markets.

- You are unable to discontinue your World of Warcraft raiding sessions.

Swing trading is an ideal option for those with a full-time job who enjoy trading on the side. This style of trading involves taking advantage of short-term price movements to make profits over time and can be done from the comfort of your own home or office. It requires less capital than a day or position trades, allowing you to maximize returns while minimizing the risks associated with holding positions overnight.

As with any form of investing or speculation, it is important to remember that every trading style has its pros and cons; ultimately, it comes down to personal preference as well as knowledge level when deciding which one best suits your needs. – Happy Swing Trading!

People also asked

Can you get rich swing trading?

Swing trading has the potential to make you wealthy. With an average yearly return of roughly 30%, you would double your capital every three years, resulting in massive growth over time. Warren Buffett, the famed investor known as the “Oracle of Omaha,” amassed his wealth by earning annual returns of roughly 20%.

How much money do you need to swing trade?

Although no account balance is required for swing trading, swing traders generally have at least $5,000 to $10,000 ready for trading. This is because most swing traders avoid risking more than 1-2% of their account balance and aim for at least $100 for every transaction.

Is swing trading good for beginners?

Swing trading is typically seen to be better for novices than scalping or day trading. Swing trading necessitates less skill and trading knowledge. Furthermore, swing trading normally takes less time because it does not require a trader to actively scan positions.