The Basics of Forex Trading

As an experienced forex trader, I have seen many beginners struggling to understand the basics of forex trading. In this post, I will share my knowledge and expertise to help you understand what forex trading is, why it matters, and how to get started.

What is Forex Trading?

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the global currency market. Traders make profits by speculating on the fluctuation of currency prices against each other. The forex market is the largest financial market in the world, with a daily trading volume of over $6 trillion.

Why is Forex Trading Important?

Forex trading plays a crucial role in global commerce, as it enables businesses and individuals to exchange currencies and facilitate international trade. Forex trading also offers opportunities for investors to make profits by speculating on the movements of currency prices. As a highly liquid market, forex trading provides traders with access to high levels of leverage, making it possible to earn significant returns with a small initial investment.

How Does Forex Trading Work?

Forex trading involves buying one currency and selling another currency at the same time, with the goal of making a profit from the difference in price between the two currencies. Currencies are always traded in pairs, with the first currency in the pair being the base currency and the second currency being the quote currency.

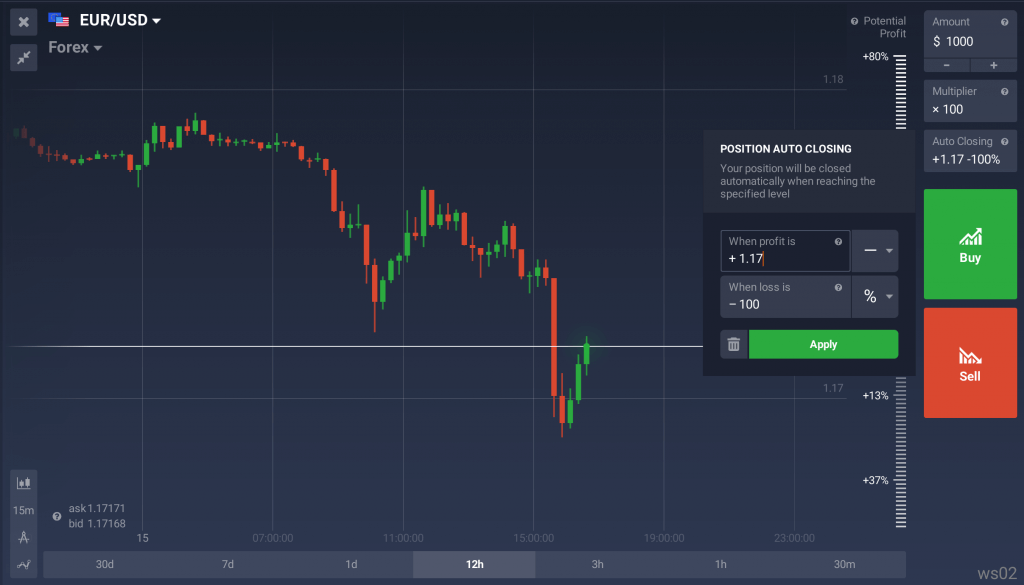

For example, the EUR/USD currency pair represents the euro as the base currency and the US dollar as the quote currency. If you believe that the euro will appreciate against the US dollar, you would buy the EUR/USD pair. If you believe that the euro will depreciate against the US dollar, you would sell the EUR/USD pair.

Basic Forex Trading Strategies

There are two basic forms of forex trades: long and short trades. In a long trade, the trader is betting that the currency price will increase, while in a short trade, the trader is betting that the currency price will decrease.

Some basic forex trading strategies that traders use include:

- Fundamental Analysis: Trading based on news and other financial and political data

- Technical Analysis: Using technical analysis tools such as Fibonacci retracements and other indicators to forecast market movements

- Combination of Both: Most traders use a combination of fundamental and technical analysis to inform their trading decisions.

Major Currency Pairs

There are hundreds of currencies in the world, but most forex trades happen in a handful of major currency pairs, which account for about 75% of all forex trading. These major currency pairs are:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

Benefits of Forex Trading

Forex trading offers many benefits, including:

- High liquidity, allowing traders to enter and exit positions easily

- High levels of leverage, making it possible to earn significant returns with a small initial investment

- 24-hour trading, allowing traders to access the market at any time

- Access to a wide range of currency pairs, providing opportunities for diversification and risk management

Risks of Forex Trading

Forex trading also involves risks, including:

- Volatility, as currency prices can fluctuate rapidly and unpredictably

- High levels of leverage, which can amplify both profits and losses

- Lack of regulation in some countries, exposing traders to fraudulent practices and scams

FAQs

What is Forex Trading?

Forex trading is the process of buying and selling currencies in the foreign exchange market. It involves the exchange of one currency for another at an agreed price, with the aim of making a profit from the fluctuations in currency prices. The foreign exchange market is the largest financial market in the world, with an average daily trading volume exceeding $5 trillion.

How does Forex Trading work?

Forex trading involves buying and selling currency pairs. Currency pairs are quoted in terms of their exchange rates, which determine the value of one currency relative to another. Forex traders can either buy or sell currency pairs based on their expectations of future price movements. They can also use leverage to amplify their potential profits, but this also increases the risk of losses.

What are the major currency pairs in Forex Trading?

The major currency pairs in Forex Trading are EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD. These currency pairs are the most actively traded in the foreign exchange market, accounting for about 75% of all trading volume.

What are the basic strategies for Forex Trading?

The basic strategies for Forex Trading are long and short trades. In a long trade, a trader buys a currency pair with the expectation that its value will increase over time. In a short trade, a trader sells a currency pair with the expectation that its value will decrease over time. Traders can also use technical analysis tools, such as Fibonacci retracements and other indicators, to forecast market movements, or fundamental analysis based on news and financial data. Most traders use a combination of both approaches to make informed trading decisions.

Conclusion

Forex trading is a complex and dynamic market that offers many opportunities for profit but also involves risks. By understanding the basics of forex trading and developing a sound trading strategy, you can improve your chances of success in this exciting and lucrative market.

References:

- Investopedia. (n.d.). Forex Trading: A Beginner’s Guide. Retrieved from https://www.investopedia.com/articles/forex/11/why-trade-forex.asp

- The Balance. (n.d.). What Is Forex Trading, and How Does It Work? Retrieved from https://www.thebalancemoney.com/what-is-forex-trading-1031015

- Investopedia. (n.d.). Forex Concepts. Retrieved from https://www.investopedia.com/articles/forex/08/forex-concepts.asp

- Admiral Markets. (n.d.). Forex Basics. Retrieved from https://admiralmarkets.com/education/articles/forex-basics

- Forex.com. (n.d.). Tips for Beginner Forex Traders. Retrieved from https://www.forex.com/en-us/trading-academy/courses/how-to-trade/tips-for-beginners-forex/

- The Balance. (n.d.). Forex Basics. Retrieved from https://www.thebalancemoney.com/forex-basics-4073516

- Forbes. (n.d.). What Is Forex Trading, and How Does It Work? Retrieved from https://www.forbes.com/advisor/investing/what-is-forex-trading/

- Trading-Market. (n.d.). The Basics of Forex Trading. Retrieved from https://trading-market.org/the-basics-of-forex-trading/

- Cortiea. (n.d.). Basics of Forex Trading. Retrieved from https://cortiea.com/basics-of-forex-trading/

- Vantage Markets. (n.d.). The Basics of Forex Trading. Retrieved from https://www.vantagemarkets.com/academy/the-basics-of-forex-trading/